This blog has been DISCONTINUED as of Q2/2013. Neoprobe is now Navidea Biopharmaceuticals and the company has reached a point in its growth that there is no need for the redundancy of an investor-generated due diligence website. Many of the links, information and current news can still be found at Investor Village NAVB Old Timers Lounge.

RECENT PRESS RELEASES

May 1, 2013: Navidea announces launch of Lymphoseek U.S. sales

April 5, 2013: Navidea retains Stern IR for Investor Relations

April 4, 2013: Navidea announces Positive Top Line Data from Interim analysis of Phase III Lymphoseek Head and Neck trial

April 3, 2013: Navidea and Molecular Neuroimaging enroll First Subject in NAV5001 trial to evaluate Dementia with Lewy Bodies

March 27, 2013: Navidea announces Enrollment of First Subject in Phase 2b trial of NAV4694 in subjects with MCI

March 13, 2013: FDA approves Lymphoseek NDA

February 4, 2013: Navidea to Collaborate with Maimonides Medical on Lymphatic Mapping in Colorectal Cancer

January 30, 2013: J.P. Morgan Asset Mgmt et al purchase 1.5M shares of NAVB in negotiated stock sale

January 3, 2013: Navidea reaches Interim Analysis Point of Phase 3 Head and Neck study of Lymphoseek

December 18, 2012: Navidea submits Lymphoseek MAA to EMA

July 26, 2012: Navidea announces $50 Million Credit Facility with Platinum-Montaur

July 26, 2012: Lymphoseek presented by Independent Investigators at 8th International Conference on Head and Neck Cancer

July 23, 2012: Head to Head comparison of AZD4694 to Gold Standard PiB for Beta Amyloid deposits presented at Alzheimer's conference

June 29, 2012: Think Equity initiates coverage of Navidea Biopharmaceuticals with a Buy rating and $6.00 price target

June 11, 2012: Data comparing AZD4694 to Gold Standard 11C-PiB in Beta Amyloid imaging presented at Society of Nuclear Medicine Meeting

Visit Navidea's company website

Navidea's Product Development Milestones and upcoming catalysts.

Check out the very latest Insider Trading activity.

NAVB IN THE NEWS (media stories)

All Navidea articles by Columbus Business First

All Navidea articles by MedCity News

April 4, 2012 Bloomberg, Taking Stock - Navidea recommendation (NAVB starts at 8:25)

February 14, 2011 Bloomberg, Taking Stock - Neoprobe outlook and products discussion

(Although not mentioned by name, this story recognizes benefits of Sentinel Node Biopsy, the procedure for which Lymphoseek is designed.)

February 8, 2011 NBC Nightly News story

February 8, 2011 New York Times article

January 12, 2011 SeekingAlpha - Neoprobe looks to become a major player in oncology

November 1, 2010 CNBC Interview - Neoprobe possible M and A target for "bidding war"

CONFERENCE CALLS

Transcript of May 8, 2013 1Q Earnings Report conference call

Transcript of March 13, 2013 Lymphoseek Post-FDA approval call

Transcript of March 7, 2013 Q4/12 and Year End Quarterly Report

Transcript of November 8, 2012 Q3 Quarterly report and business update

Transcript of August 8, 2012 Q2 Quarterly report and business update

Transcript of May 3, 2012 Q1 Quarterly report and business update

Transcript of March 13, 2013 Lymphoseek Post-FDA approval call

Transcript of March 7, 2013 Q4/12 and Year End Quarterly Report

Transcript of November 8, 2012 Q3 Quarterly report and business update

Transcript of August 8, 2012 Q2 Quarterly report and business update

Transcript of May 3, 2012 Q1 Quarterly report and business update

Transcript of March 1, 2012 Q4 Quarterly report and business update C.C.

Transcript of December 13, 2011 Inlicensing of AZD4694 from AstraZeneca C.C.

SEC FILINGS

Click here for the 2012 Year End 10K

Click here for the latest 10Q (Q3-2012)

Click here for the latest 424b filing.

Click here for a list of all SEC filings

STOCK

Common stock as of January 29, 2013 (per 425b SEC filing):

Authorized -------------- 200,000,000

Click here for the 2012 Year End 10K

Click here for the latest 10Q (Q3-2012)

Click here for the latest 424b filing.

Click here for a list of all SEC filings

STOCK

Common stock as of January 29, 2013 (per 425b SEC filing):

Authorized -------------- 200,000,000

Outstanding ------------- 117,490,109 (as of 03/31/13)

Reserved ----------------35,105,736 (as of 03/31/13)

Reserved ----------------35,105,736 (as of 03/31/13)

Fully Diluted ------------ 152,595,845 (Appx. as of 03/31/13)

Preferred Stock:

Authorized --------------- 5,000,000

Preferred Stock:

Authorized --------------- 5,000,000

Outstanding:

* Series A Preferred Stock (RETIRED)

* Series B Preferred Stock - 6,938 shares (no dividends, no voting rights) convertible into 22,687,260 shares of Common Stock (Montaur)

* Series C Preferred Stock - (RETIRED/converted to common 12/31/12)

* Series C Preferred Stock - (RETIRED/converted to common 12/31/12)

# of shareholders - 724 of record. ~8,000 including street name accounts.

Navidea began trading on the NYSE:AMEX on February 10, 2011.

DEBT and FINANCING

Effective June 22, 2010 Navidea converted all it's remaining debt into preferred stock (see Preferred Stock descriptions above), leaving it with no long term debt.

On December 29, 2011 Navidea borrowed $7 million from Hercules Technology. The secured, partially convertible loan is to be repaid monthly, interest only for the initial 6 to 12 months, with the principal then repaid over a period of 30 months.

On July 26, 2012 Navidea announced a $50 million credit facility with Platinum-Montaur, the company's largest institutional investor. As of 3/31/13 a total of $8 million had been drawn from that credit facility.

As of 01/29/2013 outstanding debt totaled approximately $13.1 million.

On July 26, 2012 Navidea announced a $50 million credit facility with Platinum-Montaur, the company's largest institutional investor. As of 3/31/13 a total of $8 million had been drawn from that credit facility.

As of 01/29/2013 outstanding debt totaled approximately $13.1 million.

Navidea, formerly Neoprobe, developed a line of Gamma-guided surgical devices that become the brand leader in a medical procedure known as Sentinel Lymph Node Biopsy (SLNB). SLNB is a widely practiced method of diagnosing cancer patients to determine if their cancer has spread from the primary tumor into the lymphatic system. This involves locating, removing and analyzing the first lymph node(s), or Sentinel Node(s), within the lymphatic system.

SLNB has emerged as the Standard of Care for breast and melanoma patients, with numerous multi-center clinical studies affirming the value of SLNB in patient care, replacing the previous method of treatment known as Axillary Lymph Node Dissection (ALND). ALND involves the removal of all lymph nodes within the nodal basin surrounding the primary tumor (typically 10-30 nodes), which causes additional patient pain, morbidity and extended recovery times, as well as occurrences of Lymphodema, nerve damage, etc.

This recent story by Brian Williams on NBC Nightly News highlights the emerging awareness of the benefits of SLNB over the traditional ALND.

Navidea’s $11~ million in annual gamma device sales covered all corporate overhead. However, the gamma device product line presented limited growth opportunity. Substantial growth was possible only through the addition of other drug candidates to Navidea's development pipeline.

Therefore, in August, 2011 Neoprobe sold this line of Gamma Guided devices for $30 million in cash and up to $20 million in additional royalties, allowing it to focus solely on the development of its radiopharmaceutical diagnostic drugs in the pipeline, and to add additional, complementary drugs in the future.

DEVELOPMENT PIPELINE

There are five (5) distinct drug platforms currently owned and/or licensed by Navidea;

(1) Lymphoseek, (2) NAV4694, (3) RIGScan CR, and E-IACFT (Altropane). A fifth platform, Activated Cellular Therapy (ACT) is not currently in development.

Lymphoseek - (Technetium Tc99m DTPA-mannosyl-dextran) - A new, best-in-class, radio labeled tracer, designed to replace various colloid-based radiotracers currently being used for lymphatic mapping and SLNB.

Lymphoseek is a proprietary radioactive tracing agent being developed for use in connection with gamma detection devices in pre-operative lymphoscintigraphy imaging and in a surgical procedures known as Intraoperative Lymphatic Mapping or Sentinel Lymph Node Biopsy (SLNB). Various videos describing these procedures can be found here:

Sentinel Lymph Node Biopsy (Breast - Johns Hopkins)

Sentinel Lymph Node Mapping in Breast Cancer (Breast - USF)

Sentinel Lymph Node Biopsy (Melanoma)

Lymphoseek works by binding to a specific receptor found on the surface of dendritic cells and macrophages, which reside in high concentration in lymph nodes. This receptor-targeted property of Lymphoseek enables it to attach to and remain within lymph nodes. (Map of the body's Lymphatic system).

Lymphoseek Mechanism of Action (video)

NEW Lymphoseek,com website

Two phase III multi-center clinical trials for Lymphoseek in patients with breast cancer or melanoma have concluded. A third phase III clinical study to evaluate the efficacy of Lymphoseek as a sentinel lymph node tracing agent in patients with head and neck squamous cell carcinoma is currently ongoing. To date Lymphoseek is the first and only receptor-targeted agent developed specifically for ILM.

The Lymphoseek NDA submitted by the company in August 2011 includes results from two complete phase III studies of Lymphoseek, NEO3-05 and NEO3-09, performed in patients with either breast cancer or melanoma. The primary endpoint for both the NEO3-05 and NEO3-09 studies was the concordance (or the rate of agreement) on a lymph node count basis of Lymphoseek with vital blue dye, a long-standing, FDA-approved, on-label agent for lymphatic mapping and appropriate "Truth Standard" comparator for registration purposes. In both of the phase III studies (NEO3-05, NEO3-09), the concordance of Lymphoseek to vital blue dye was highly statistically significant (p<0.0001).

Lymphoseek met all primary and secondary endpoints across both studies. Secondary endpoints were also assessed, including the false negative rate (or failed detection rate) of Lymphoseek versus vital blue dye. This analysis evaluated the ability of vital blue dye and Lymphoseek to detect lymph nodes that potentially contained cancer cells, as determined by pathology evaluation. In both studies combined, vital blue dye exhibited a failed lymph node detection rate of more than 20%, whereas Lymphoseek showed a failed lymph node detection rate of approximately 1%, or twenty-fold lower than vital blue dye, a difference that was also highly statistically significant (p<0.002). Because the key objective of performing ILM is to potentially identify cancer cells when they are present in lymph nodes, reduction of the failed lymph node detection rate is important.

In more than 500 subjects receiving Lymphoseek to date, including those studied as a part of the NEO3-05 and NEO3-09 studies, no drug-related serious adverse events or clinically significant drug-related adverse events have been reported.

Sentinel Lymph Node Biopsy (Breast - Johns Hopkins)

Sentinel Lymph Node Mapping in Breast Cancer (Breast - USF)

Sentinel Lymph Node Biopsy (Melanoma)

Lymphoseek works by binding to a specific receptor found on the surface of dendritic cells and macrophages, which reside in high concentration in lymph nodes. This receptor-targeted property of Lymphoseek enables it to attach to and remain within lymph nodes. (Map of the body's Lymphatic system).

Lymphoseek Mechanism of Action (video)

NEW Lymphoseek,com website

Two phase III multi-center clinical trials for Lymphoseek in patients with breast cancer or melanoma have concluded. A third phase III clinical study to evaluate the efficacy of Lymphoseek as a sentinel lymph node tracing agent in patients with head and neck squamous cell carcinoma is currently ongoing. To date Lymphoseek is the first and only receptor-targeted agent developed specifically for ILM.

The Lymphoseek NDA submitted by the company in August 2011 includes results from two complete phase III studies of Lymphoseek, NEO3-05 and NEO3-09, performed in patients with either breast cancer or melanoma. The primary endpoint for both the NEO3-05 and NEO3-09 studies was the concordance (or the rate of agreement) on a lymph node count basis of Lymphoseek with vital blue dye, a long-standing, FDA-approved, on-label agent for lymphatic mapping and appropriate "Truth Standard" comparator for registration purposes. In both of the phase III studies (NEO3-05, NEO3-09), the concordance of Lymphoseek to vital blue dye was highly statistically significant (p<0.0001).

Lymphoseek met all primary and secondary endpoints across both studies. Secondary endpoints were also assessed, including the false negative rate (or failed detection rate) of Lymphoseek versus vital blue dye. This analysis evaluated the ability of vital blue dye and Lymphoseek to detect lymph nodes that potentially contained cancer cells, as determined by pathology evaluation. In both studies combined, vital blue dye exhibited a failed lymph node detection rate of more than 20%, whereas Lymphoseek showed a failed lymph node detection rate of approximately 1%, or twenty-fold lower than vital blue dye, a difference that was also highly statistically significant (p<0.002). Because the key objective of performing ILM is to potentially identify cancer cells when they are present in lymph nodes, reduction of the failed lymph node detection rate is important.

In more than 500 subjects receiving Lymphoseek to date, including those studied as a part of the NEO3-05 and NEO3-09 studies, no drug-related serious adverse events or clinically significant drug-related adverse events have been reported.

Lymphoseek is the only lymphatic mapping agent designed for the lymphatic system, and is specifically engineered to bind to lymphatic tissue. Lymphoseek is injected in the vicinity of solid tumors, where it drains outward through the lymphatic system to the most predictive (Sentinel) lymph node(s). This Sentinel node is then removed surgically and examined in pathology for the presence of metastases, to determine if cancer has spread from the tumor via the lymphatic system. The presence or absence of cancer in the Sentinel Node is then used to structure the best treatment program for the patient.

In FDA clinical trials Lymphoseek demonstrated the following characteristics as compared to the products being used off-label:

1) More rapid clearance of the injection site (clearing the injection site as fast as 15 minutes, 8x faster than colloid-based products)

2) Statistically identical lymph node uptake to the current Sulfur Colloids

3) Lower “pass through” rate, to other non-sentinel lymph nodes

4) Longer nodal binding period (~24 hours)

5) Lower False Negative Rate (as low as 0% in clinical trials)

6) Pain-free injection, due to being ph-balanced (Lymphoseek injection does not require local anesthetic)

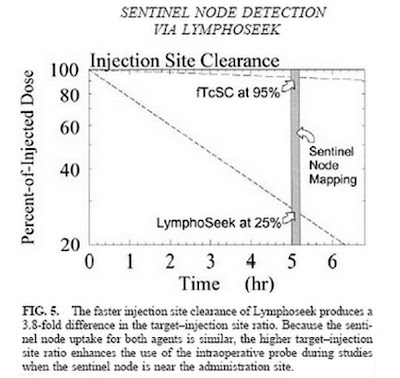

The following chart (Dr. Anne Wallace, et al) of a clinical comparison between Lymphoseek and filtered sulphur colloid (fTcSC) shows the site clearance advantages of Lymphoseek. Sulphur colloid is the predominant product currently being used off-label for Sentinel Lymph Node procedures. Five hours after injection of both compounds, 95% of the sulphur colloid (fTcSC) remained trapped at the injection site, while 75% of the Lymphoseek had left the injection site and migrated into the lymphatic system.

Lymphoseek completed preclinical testing and analysis in 2001.

Phase I clinical trials in breast and melanoma cancers were completed in 2004 (Links: Melanoma trial; Breast cancer trial). Additional Phase I trials for breast and melanoma (next day surgery), prostate and colon cancers are underway.

Phase II trials were completed in 2007 ( see Annals of Surgical Oncology Peer Review). This trial was an efficacy-based trial to determine the sensitivity of Lymphoseek in identifying sentinel nodes in patients with breast cancer and melanoma. Post-operative pathology results confirmed that Lymphoseek identified "hot spots" in 94.5% of patients in nuclear medicine imaging studies prior to surgery. Intra-operatively, Lymphoseek identified at least one regional lymph node in 75/78 subjects (96.2%); 46/47 (97.9%) with melanoma and 29/31 (93.5%) with breast cancer, confirming a high level of performance in a diverse set of cancers. Overall sensitivity by node was 92.0% with a corresponding 8% false negative rate. Five serious adverse events occurred; none related to Lymphoseek. The Phase II concordance rate was 97.1% for melanoma patients and 96% for breast cancer patients, after excluding those with bilateral disease. Patients with bilateral disease were excluded from Phase III trials to insure clinical consistency.

A peer review of Lymphoseek's Phase II clinical study can be found here, in the April. 2011 edition of Annals of Surgical Oncology.

A peer review of Lymphoseek's Phase II clinical study can be found here, in the April. 2011 edition of Annals of Surgical Oncology.

There are three (3) separate Phase III clinical trials for Lymphoseek.

2 - Breast and Melanoma (Superiority) – Completed May 3. Neoprobe announced Lymphoseek met all clinical endpoints. ClinicalTrials.gov website.

3 - Head and Neck (Sentinel) - Enrolling. Completion anticipated in 2013, but interim analysis may allow early termination as soon as Q4-2012. ClinicalTrials.gov website.

The Breast and Melanoma Phase III trial was designed with a primary endpoint of 94% concordance against the only current FDA approved lymphatic mapping agent, Lymphazurin (Isosulfan Blue Dye), Blue Dye is a visual marking agent currently used as the standard for lymphatic mapping. It is not a radiological and is not detectable using radio detection technology. Additional details and a description of this comparative study can be found at FDA ClinicalTrials.gov. Fifteen (15) institutions participated in the U.S. and abroad.

On December 8, 2008 Lymphoseek Breast and Melanoma interim results were announced, reaching 135 nodes to date and a top-line accuracy in excess of 96%. On March 24, 2009 Lymphoseek Breast and Melanoma preliminary results were announced, confirming that the trial achieved the targeted endpoint of 277 nodes. After the completion of the site audits, the final Phase III results (97% accuracy) were announced on May 7, 2009. Final, FDA reviewed audited results were released in Q4-2009.

Neoprobe submitted this data to the FDA and had a successful End of Phase 3 meeting with the FDA in March, 2010. Here is an excellent presentation summary of the Breast portion of the Phase III study.

The second Phase III Breast and Melanoma (Superiority) trial was designed to validate Lymphoseek as a superior lymphatic tracer over the non-radiological tracing agent Isosulfan Blue (Blue Dye). Results of the first Phase III trial revealed that Lymphoseek identified 86 additional Sentinel Nodes that were missed by the Blue Dyes. This second Phase III trial is designed to provide additional data that would support Lymphoseek superiority claims. Details of this trial can be found at ClinicalTrials.gov.

The third Phase III trial (Head and Neck Sentinel) (enrolling) is designed to validate Lymphoseek as a Sentinel Node targeting agent, with the purpose of obtaining FDA approved labeling for Sentinel Lymph Node Biopsy procedure. This validation will involve approximately 180 patients with Head and Neck Carcinoma, and will be complete upon reaching 58 patients with positive nodal disease. The primary trial endpoint is no greater than a 10% False Negative Rate (FNR). On April 4, 2013 Navidea announced Top-Line results of the interim analysis of the Head and Neck Trial data.

In the Breast and Melanoma phase of the trial, Lymphoseek demonstrated a Zero (0%) percent FNR. The Head and Neck trial commenced May 28, 2009. The trial details can be viewed at ClinicalTrials.Gov. A Springer reference to this trial can be found in the journal, Current Oncology Reports (April 2, 2010 edition).

In the Breast and Melanoma phase of the trial, Lymphoseek demonstrated a Zero (0%) percent FNR. The Head and Neck trial commenced May 28, 2009. The trial details can be viewed at ClinicalTrials.Gov. A Springer reference to this trial can be found in the journal, Current Oncology Reports (April 2, 2010 edition).

In November, 2007 Neoprobe announced a long-term exclusive distribution agreement for Lymphoseek (U.S. rights) with Cardinal Health (CAH), the nations largest radiopharmaceutical distributor. According to Neoprobe's management, the Cardinal agreement provides for Neoprobe to receive 53+% of the top-line retail sales price. David Bupp, former CEO, has stated that Lymphoseek will have typical pharmaceutical gross margins of 70+%. During the Investor Conference Call for Q4-2009, Mr. Bupp stated that Cardinal Health has projected a 50% market penetration within 18 months after the commercialization of Lymphoseek.

The latest worldwide market potential for Lymphoseek annual sales is estimated to be $450 million. Sales estimates for Lymphoseek were initially based upon a price of $150 per dose for Lymphoseek but have been priced at $300 when commercial sales commenced on May 1, 2013. See management's estimated $450 million annual sales potential for Lymphoseek.

Navidea anticipates the issuance of a reimbursement code for Lymphoseek by October 1, 2013, allowing for reimbursement by Medicare, Medicaid and other large insurance providers.

Update: On March 13, 2013 the FDA approved the Lymphoseek NDA and Cardinal Health launched commercial sales on May 1, 2013.

Securities follows Neoprobe. According to its website, WBB targets micro-cap medical companies that it perceives to be undervalued or to be on the verge of a break-through. Click here for a copy of WBB Securities initial NEOP Analysis report (May 8, 2009). WBB currently has NEOP rated as a Strong Buy, raising its 12-month price target from $6.00 to $7.50.

Latest WBB Securities Update Report - February 10, 2011: Update ReportTaglich Brothers initiated coverage of Neoprobe on July 23, 2009 and has a 12-month price target of $4.00. Taglich Brothers is compensated by the company for their analysis reports. Click here for Taglich Brothers' NEOP Initial Research Report.

Latest Taglich Brothers Update Report - December 22, 2010: Updated Research Report

TriPoint Global Research initiated coverage of Neoprobe on September 21, 2010, with a Market Outperform rating and a 12-month target of $5.00. Mr. Fischer is not compensated by Neoprobe to follow or report on the company. Click here for the Initial Coverage Disclosure Note: All information herein was prepared by investors for investors using sources deemed to be accurate and reliable to the best of our knowledge. No information contained on this site has been prepared, provided, reviewed or endorsed by Neoprobe Corp. and this website is not affiliated with Neoprobe Corp., in any way.

NAV4694

The worldwide development and marketing rights for the diagnostic uses of AZD4694 were inlicensed by Navidea from AstraZeneca in December, 2011 (See PR). This compound (renamed NAV4694) will be developed by Navidea as an imaging agent to diagnose and assess Alzheimer's Disease. AZD4694 completed Phase I and Phase II FDA trials successfully, sponsored by AstraZeneca.

Navidea will complete the clinical trial program in collaboration with AstraZeneca. An additional Phase IIB study commenced September 18, 2012.

Estimated trial costs to Navidea have been estimated at $15-$16 million by Navidea management. If successfully commercialized the worldwide market potential has been estimated to exceed $1 Billion in annual revenues. A competing product, Amyvid (sponsored by Eli Lilly), was approved by the FDA in Q2-2012 which is expected to pave the way for FDA approval of NAV4694.

A clinical validation study of NAV4694 can be found here, in The Journal of Nuclear Medicine.

A clinical validation study of NAV4694 can be found here, in The Journal of Nuclear Medicine.

E-IACFT (Altropane)

The worldwide development and marketing rights for Altropane were inlicensed by Navidea from Alseras Pharmaceuticals on July 31, 2012 (See PR). This compound will be developed by Navidea as an imaging agent to diagnose and assess Parkinson's Disease, and may have additional potential to asses Lewy Body Dementia. Altropane has completed Phase I and Phase II FDA trials successfully (600+ patients to date) and is Phase III ready with an existing FDA-approved SPA protocol. Navidea is currently updating and confirming the existing SPA, and intends to commence a Phase III study in early 2013 for the diagnosis of Parkinsons Disease and a Phase IIB study for the diagnosis of Lewy Bodies Disease.

RIGScan CR 49

RIGScan CR 49

RIGS, a monoclonal antibody based radiotracer tagged with Iodine-125 that binds to metastatic tissue, is intended to improve the identification and removal of all cancerous tissue in colorectal cancer surgeries. Having completed all Phase I, II and III clinical trials successfully, the FDA did not approve the original BLA in 1997 due to the lack of documentation quantifying the patient survival benefits. With the passage of time since the initial review by the FDA, the survival benefit to the patients treated in the RIGS clinical trials has become increasingly apparent, as shown in the Schneebaum Survival Study, a RIGS study by R. Lee Moffit Cancer Center and another RIGS review in the Annals of Surgery.

Subsequent meetings with the FDA and EMEA/EU (Europe) have provided guidance for a new, confirmatory trial designed to fully document the patient survival differentials needed for a successful review and approval of RIGS by both regulatory agencies. Having received a more receptive response from the EU, Neoprobe submitted the final survival protocol to that agency first, and received protocol approval from the EMEA in late 2008 to commence the final Survival Study. This approval included an acknowledgement from the EU of the clinical utility of RIGS and the possibility of applying for a Conditional Marketing Authorization (CMA), to begin selling the product prior to formal approval.

The company announced a contract with Laureate Pharma, Inc. to produce the RIGS biologic cell line, which is now completed. After subsequent meeting with FDA, and at the advice of FDA, Navidea is converting the murine-based antibody to a human-based antibody which is expected to be complete in 2H/2013 at which time RIGS is expected to enter another Phase II clinical trial to assess the safety profile of the new humanized version of the antibody prior to starting a final Phase III pivotal trial.

The company announced a contract with Laureate Pharma, Inc. to produce the RIGS biologic cell line, which is now completed. After subsequent meeting with FDA, and at the advice of FDA, Navidea is converting the murine-based antibody to a human-based antibody which is expected to be complete in 2H/2013 at which time RIGS is expected to enter another Phase II clinical trial to assess the safety profile of the new humanized version of the antibody prior to starting a final Phase III pivotal trial.

For prognostic applications, third party consultants have estimated that RIGS could command $6,000 per operative dose. With 109,000 cases of colon cancer in the U.S. (American Cancer Society) and 940,000 cases worldwide (World Health Organization) the potential annual sales for RIGS ranges from $1 Billion to $6 Billion per year, depending on market penetration. Consultants have pegged the latest RIGS market potential estimate at approximately $3.0 Billion.

Activated Cellular Therapy (ACT)

This immunotherapy platform utilizes patented technologies to reap certain patient antibodies, activate and replicate them in a labratory setting, and reinfuse them back into the patient to boost immune responses to various diseases including Chronic Fatigue Syndrome, AIDS, etc.. This technology is currently idle, and the company has employed an investment bank to explore and solicit funding sources necessary to advance the product development. As a result of recent data from a previous clinical trial studying Chronic Fatigue Syndrome and documenting improved patient response, Neoprobe recently announced the potential reactivation of its ACT technology and is continuing to assess the potential of this technology, but it remains inactive at this time.

INVESTMENT PRESENTATIONS

Management gives presentations to institutional investors at various seminars. These often reveal information that may not otherwise be in public filings or printed releases. The presentations typically expire in 60-90 days, but will be linked to this section while active. (You may have to register to listen, but it takes only seconds)

Jine 4, 2013 - Jefferies Global Healthcare Conference, New York, NY

April 30, 2013 - Needham Healthcare Conference, New York, NY

April 5, 2013 - 20th Annual Future Leaders in Biotech Conference, New York, NY

March 4. 2013 - Cowen and Company 33rd Annual Healthcare Conf., Boston, MA

February 11, 2013 - BioCEO and Investor Conference, New York, NY

January 8, 2013 - Biotech Showcase 2013 - San Francisco, CA

November 14, 2012 - Credit Suisse Healthcare Conf., Phoenix, AZ

April 30, 2013 - Needham Healthcare Conference, New York, NY

April 5, 2013 - 20th Annual Future Leaders in Biotech Conference, New York, NY

March 4. 2013 - Cowen and Company 33rd Annual Healthcare Conf., Boston, MA

February 11, 2013 - BioCEO and Investor Conference, New York, NY

January 8, 2013 - Biotech Showcase 2013 - San Francisco, CA

November 14, 2012 - Credit Suisse Healthcare Conf., Phoenix, AZ

ANALYSTS

Navidea has numerous independent analysts providing coverage. Click here for a current list of Navidea Analysts.

Navidea has numerous independent analysts providing coverage. Click here for a current list of Navidea Analysts.

Securities follows Neoprobe. According to its website, WBB targets micro-cap medical companies that it perceives to be undervalued or to be on the verge of a break-through. Click here for a copy of WBB Securities initial NEOP Analysis report (May 8, 2009). WBB currently has NEOP rated as a Strong Buy, raising its 12-month price target from $6.00 to $7.50.

Latest WBB Securities Update Report - February 10, 2011: Update ReportTaglich Brothers initiated coverage of Neoprobe on July 23, 2009 and has a 12-month price target of $4.00. Taglich Brothers is compensated by the company for their analysis reports. Click here for Taglich Brothers' NEOP Initial Research Report.

Latest Taglich Brothers Update Report - December 22, 2010: Updated Research Report

TriPoint Global Research initiated coverage of Neoprobe on September 21, 2010, with a Market Outperform rating and a 12-month target of $5.00. Mr. Fischer is not compensated by Neoprobe to follow or report on the company. Click here for the Initial Coverage Disclosure Note: All information herein was prepared by investors for investors using sources deemed to be accurate and reliable to the best of our knowledge. No information contained on this site has been prepared, provided, reviewed or endorsed by Neoprobe Corp. and this website is not affiliated with Neoprobe Corp., in any way.